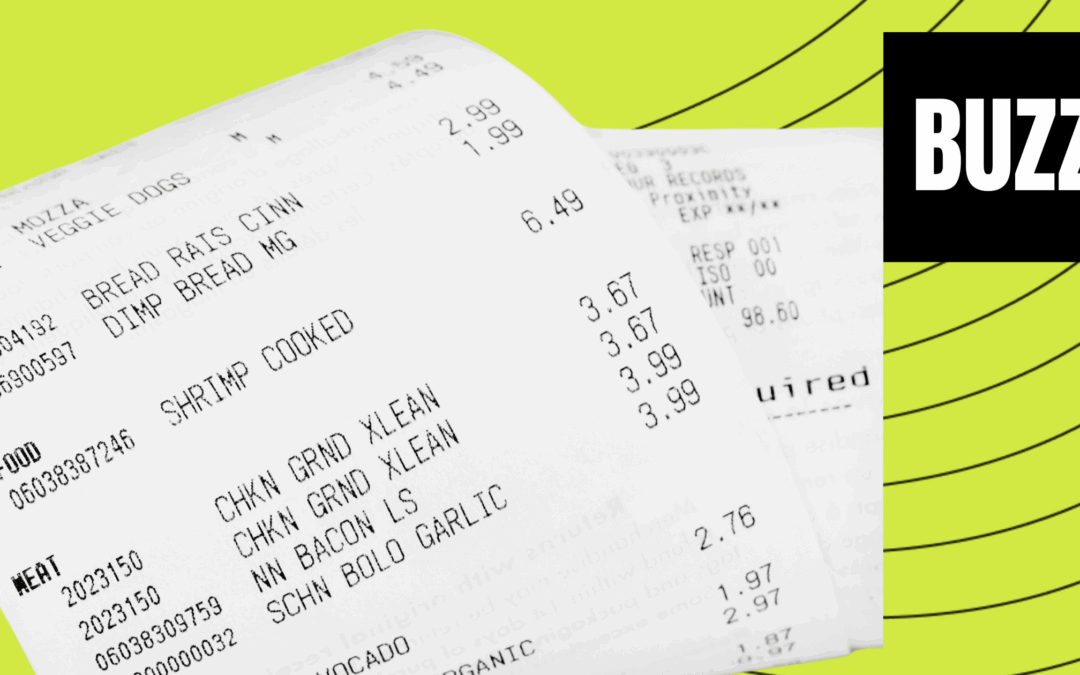

We all know the feeling. It’s the end of the tax year, and you’re knee-deep in a mountain of crumpled receipts—some faded, some missing, some with no clue what they were for. You’re trying to piece together a year’s worth of expenses while the clock ticks down to the filing deadline.

Sound familiar?

The good news is, it doesn’t have to be like that. Getting a handle on your receipt management now can save you hours of stress—and potentially a chunk of tax, too—when it’s time to file.

Here’s how to get organised early, keep your records clean, and avoid the last-minute scramble.

Why Receipts Matter More Than You Think

Every receipt tells a story. That sandwich on the motorway? Business travel. The new drill? Tools of the trade. The website hosting? Marketing expense.

If it’s a legitimate business cost, it can help reduce your tax bill—but only if you’ve kept the proof.

No receipt = no claim = paying more tax than you should.

The Trouble with Leaving It Too Late

Waiting until the end of the year to sort your receipts usually leads to one of three things:

- You lose track of what’s what

- You forget which purchases were personal or business

- You miss out on claiming back legitimate expenses

And the worst part? It turns a quick task into a full-blown admin nightmare right when you’ve got a million other things to deal with.

Start Good Habits Now and Save Hours Later

The key is little and often. It’s not about being perfect—it’s about making it easy to stay on top of things throughout the year.

Here’s how to do it:

Snap Receipts on the Go

Don’t wait until you get home. Take a photo of each receipt as soon as you get it—whether it’s a physical copy or emailed to you. It takes 10 seconds and keeps you covered.

With Buzz, you can upload receipts straight into your account—tag them by category and never lose track again.

Use a Digital System (Ditch the Shoebox)

Forget stuffing receipts in gloveboxes, coat pockets, or that mystery kitchen drawer. Use a cloud-based system that stores and sorts your receipts in one place.

Even better if it links directly to your bookkeeping or accountant—Buzz has tools that do just that.

Log What It’s For

Don’t just store the receipt—add a quick note. What was it for? Which job or project? This helps jog your memory and gives your accountant what they need to claim it back properly.

Future-you will thank you for being specific.

Sort Weekly (Not Yearly)

Set aside 10 minutes each week to check your receipts, match them to transactions, and tag them correctly. It’s way less painful than doing it all in one go come March.

Consistency now means smooth sailing later.

Keep Digital and Paper Copies (Just in Case)

HMRC accepts digital receipts—but it’s still smart to keep paper copies for higher-value purchases or anything that might be questioned. Keep them in a folder, dated and labelled.

It’s simple, but it can make all the difference if you ever face a query.

Buzz Can Help You Keep It Together

At Buzz Accounting, we don’t just help you file your accounts—we help you stay organised all year round. Our tools make it easy to:

- Snap, upload, and tag receipts on the go

- Keep everything tidy, secure, and ready for your tax return

- Work seamlessly with your accountant (that’s us!) to make filing stress-free

No more last-minute panics. No more guesswork. Just clean, simple, done.

Ready to Stop the Receipt Chaos?

If you’re tired of the paper trail nightmare every year-end, let’s sort it. We’ll help you build a simple, stress-free system for managing receipts—so you can spend more time running your business, and less time chasing bits of paper.

👉 Book a call with Buzz today and let’s get you organised, once and for all.